For Large SAP & Digital Transformational Programs, a New Approach is Needed: The Value Approach

Introduction

This Is the third of a series of introductory blogs discussing the Why, What and How (including the difficulties) of Large Transformational Programs like SAP and Digital change.

One of the main concerns of the CEO and C Suite members in these hugely costly Programs is Return on Investment (ROI)…will this Program return the required level of VALUE for us?

The levels of disappointment and sometimes failures of these Programs may not be new to the business world, rapid change in the business environment coupled with the sense of urgency to optimize investments is causing company executives to seek and demand measurable business value from their investments across all their digital transformation initiatives.

On average, large projects run 45% over budget and 7% over time, while delivering 56% less value than predicted - McKinsey.

According to an Everest Group study a whopping 78% of enterprises failed to meet their business objectives and acquire the desired results from their investment.

Recognizing some of the issues behind this can help ensure that actions are taken upfront to make certain that transformation initiatives deliver on promised business value.

The Value Equation

What is Value? “Value” means different things to different people, especially Customers and Stakeholders, therefore Context is Key.

The Manager may Value a new report or analytics to give a new insight, a user may Value the elimination of a tedious manual process and various stakeholders at an end-to-end process may independently view Value differently as Value moves along that process.

Ultimately the Value proposition that is delivered to the Customer results in yet another view of Value therefore all these different contexts need to be taken into account when capturing Value.

Starting to feel that “Value” is complex?..read on.

Businesses capture and produce 4 types of Value:

- Business Value (Profit, Asset & Share Price growth)

- Social Value (Honesty, Learning, Support, Care)

- Financial Value (Value =cost + quality, measured by revenue or income)

- Customer Value (Solutions = Outcomes + experiences, time saved, peace of mind, excitement/pleasure)

The Drivers of these Values are:

- Customer Centricity

- Service Excellence

- Operational Efficiency

- Asset Growth

- Profit Growth

- Business Transformation

These 6 “Value” Measures should be used to describe the goals and objectives of the business, and strategies and tactics are formulated and executed using them to enable the business to grow.

Let’s start simply by taking an overview of Value …the Value Equation.

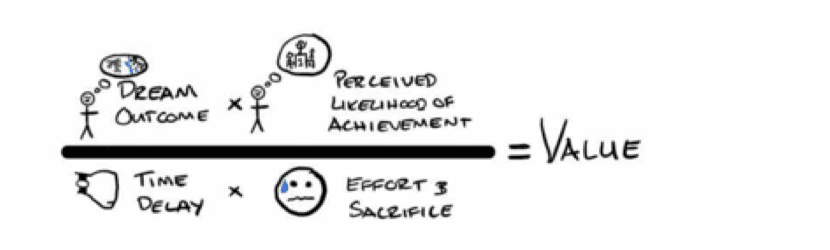

Figure 1. The Value Equation

The Context being used here is the driver of “Business Transformation” (a Programme or Project), the Value Equation has 4 elements:

- Dream Outcome (end state/outcome, can be expressed in real numbers)

- Perceived Likelihood of Achievement (probability of success, a high %)

- Time Delay (the time between inception & operationally embedded)

- Effort & Sacrifice (what YOU are required to do to achieve your Dream outcome, financial, man-days, impacts etc)

Our goal here is to Increase the Numerator's 2 elements, decrease the Denominator's 2 elements, and always return a Value greater than 1.

Any Transformation programme should start with this Value Equation in its quest to understand and capture Value.

The Value Equation is the key which opens the lock on the door to successful transformation understanding and execution.

As an example, the Time Delay element is very interesting as it expresses the latency between “pulling the trigger” on a Project and that Project being Operationally embedded and producing benefits…this is the Value Paradox.

The Value Paradox

This is where the PowerPoint runs into reality, Value is only achieved after the Project is successful, has gone live, defects & tickets cleared, transitioned to support and the Business and its Users have accepted the Project and are using it as intended …Only then can Value be harvested, and the benefits gained.

Value is ONLY captured in Operations! YOU the Business are accountable and responsible for this!

No matter what Vendors and SI’s say about Value, their Value Management thesis, Vision to Value strategies and Value tasks embedded into their Activate Projects plans…. true Value can only be delivered by the Business (the Vendor/Si’s will be long gone before Value bears’ fruit!).

Value Model (Value Chains, Value Streams, Value Ecosystems)

OK, the Value Equation is a starting point for a Transformational Initiative however we need to understand “Value” at a deeper level to ensure that it flows through to success.

A Value-driven Business must specify the Value Model that will drive how the Operating Model will deliver its Business Model…” Wow what a mouthful”.

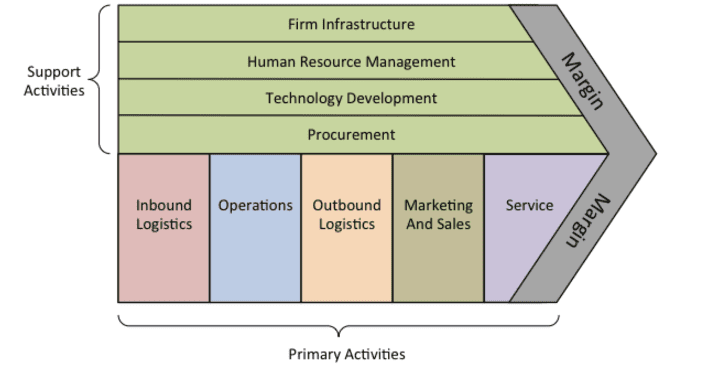

The Value Model describes what constitutes value for a Business and its customers, encompassing where the Value is created, the exchange of Value between different Stakeholders and most importantly, how to find new opportunities to create value in the wider Business ecosystem.

The Value Model directs WHAT Value-added outcomes/experiences customers receive to form their Value Propositions and hence WHAT Value streams are required to support their delivery. These Value streams support the business's overall Value Chain by directing resources and business activities to perform optimally, to deliver the desired “margin”.

Value streams are implemented or executed through the Businesses Operating Model (Figure 3) where they may also need to be to be transformed to remain optimal.

Figure 2. Porters Value Chain

A Business delivers its Value propositions to its customers, through its Value streams.

Value Streams are the internal value propositions that join to create an end-to-end solution or external value propositions with a set of value-added outcomes and experiences for its customer. They fulfil customers’ expectations in exchange for payment via a transaction.

Value Streams are supported by the Businesses Capabilities which are sets of resources in the business Operating Model optimised to perform a specific business activity and Processes embedded in the Business’s systems.

Value Ecosystems are a wider collection of Value producing Business activities performed by “Other parties” in the business ecosystem surrounding the Business. It allows the Business to leverage Capabilities that are better and faster than their own to achieve ‘’Network effects” and enhance the overall Value Chain.

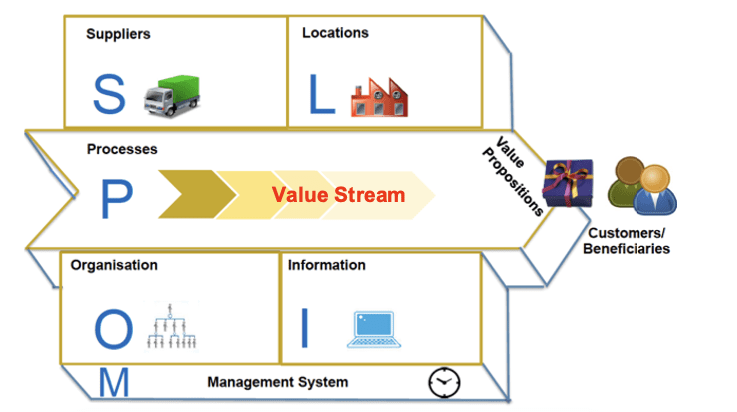

Figure 3. Operating Model Canvas

Value Streams, Processes & Capabilities

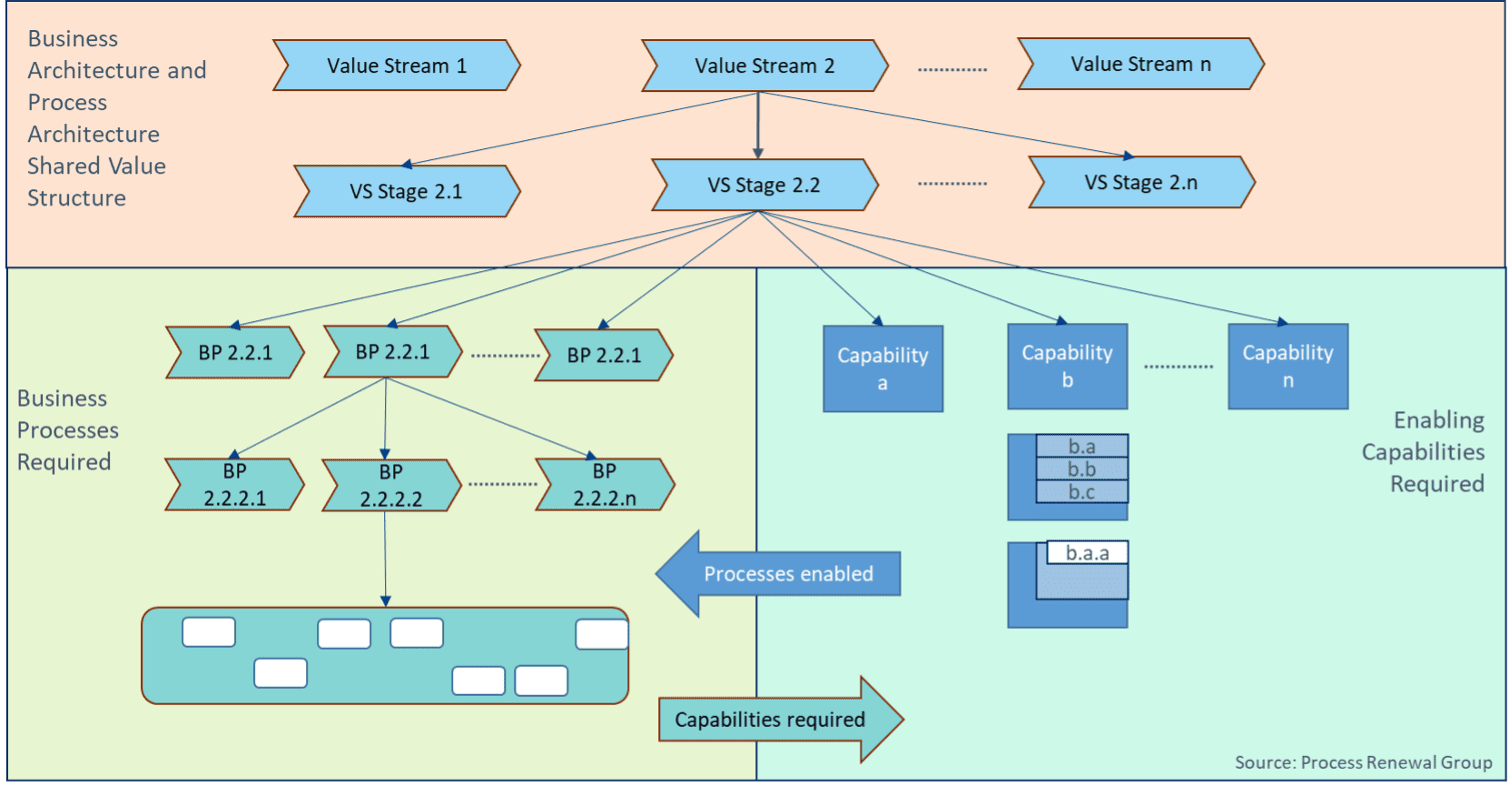

The Value stream is an end-to-end collection of activities (Value stages) that create a result (Value proposition) for a customer (or triggering stakeholder). This is the Business Architectural (BA) perspective of Value Creation!

The Enterprise Architectural (EA) perspective comes from Business Process Models identifying outputs of value, embedded in the Business's “On Premise” or “Cloud-based” systems, however other processes that are not value items to customers per se. such as regulatory reports are also included.

Both perspectives are needed to support Value creation!

Similar yet Different: Value Streams and Business Processes

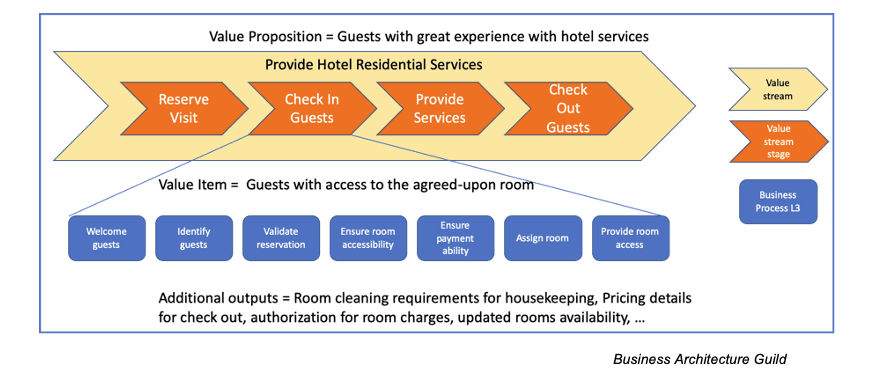

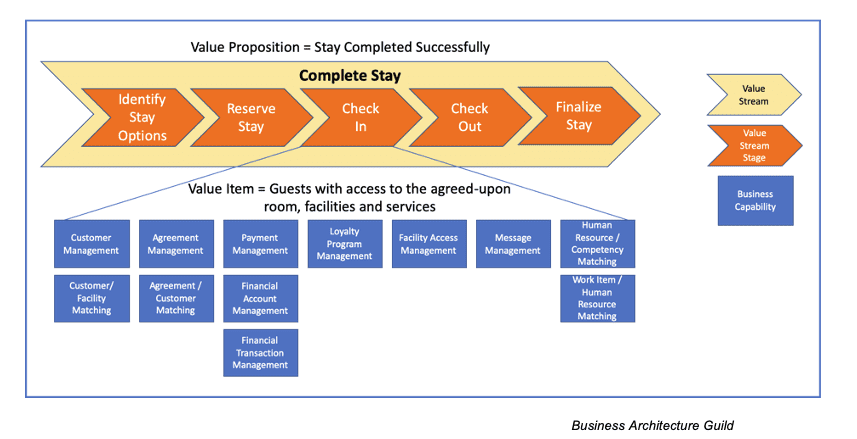

These (similar yet different) perspectives are illustrated by the following two Figures (4 & 5) that describe the ‘Complete Stay’ value stream for the customers of a hospitality organization.

Figure 4. Value Stream, Stages & Business Processes

Figure 4 above illustrates examples of level 3 business processes that would be cross-mapped to the ‘Check In’ value stream stage as seen by a customer.

In contrast, Figure 5 below illustrates examples of the capabilities that would be cross-mapped to the ‘Check In’ value stream stage. The capabilities shown are a mix of level 1, 2, and 3 capabilities.

Figure 5. Value Stream, Stages & Capabilities

From Figures 4 & 5 Business process & Capability views represent very close perspectives on the creation of the same value.

The business architecture and process management communities both focus on value creation for stakeholders but with different perspectives. The former views value streams in terms of stakeholder value items, while the latter creates end-to-end process models that identify outputs of value.

However, both communities require models at the value-creation level.

The EA/business process community needs a detailed set of activities, while the BA/business architecture community requires a cross-mapping of business capabilities.

In manufacturing, the value stream stages mirror the operational processes, while in services, the operational process path may have to accommodate pauses and iterations, but the end goal remains the same.

The EA/business process community work at multiple levels including lower levels of process where there is a tendency to concentrate on the configuration and integration of detailed processes into the Enterprise systems and the connection to Value streams at a higher level gets difficult to trace or is lost.

The EA/business process community must also use a higher level of modelling to ensure there is a connection between Processes, Value items and successful Value outcomes.

The two communities recognize that they represent close perspectives on the creation of the same value and use higher-level modelling and representation for cross-functional management responsibility and ownership.

There is a need for consistency in naming conventions and structure between business process maps and value streams for effective collaboration. (See Figure 7)

Practically speaking, if an organization is using business architecture to identify and map their value streams, it can use those same value streams as the starting point for its business process modelling efforts. This will ensure alignment between the two perspectives and allow for a more efficient and effective approach to managing and improving operations.

In conclusion, the business architecture and business process perspectives offer complementary views of value creation within an organization. While value streams provide a high-level, value-based perspective, business processes offer a more detailed look at the operational activities required to deliver that value.

By aligning these two perspectives, organizations can create a more cohesive and comprehensive approach to managing their operations, ultimately leading to greater efficiency, effectiveness, and value for all stakeholders by avoiding a disconnect between Business Process, Capability and Value.

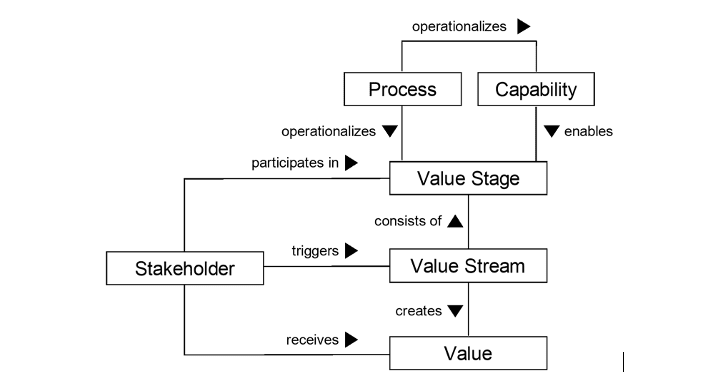

Figure 6. shows the relationships between value, value streams, value stream stages and process & capability.

Figure 6. Value Stream Modelling Relationships (Business Architecture Guild)

Figure 7. Mapping off Capability & Process to Value Stream Stage

As shown in Figure 7, processes and capabilities can leverage the same shared value creation structure.

Value Streams & The Project Portfolio

Traditionally, program management focuses on balancing trade-offs among scope, schedule, and budget, overseen through a program management office (PMO). However, this approach is often limited, as it implies that one of those three elements must be subordinate to the other two. It also lacks the critical Capabilities needed to capture Value and drive Change without sacrificing project scope, schedule, or budget.

In most Transformational Programs there are multiple Projects involving differing SI’s/Vendors and groups of consultants “led” by inexperienced Businesses leaders trying to bring things together, which often results in poor Value delivery and even in some instances Projects Overlapping Value and cancelling each other’s benefits out.

Value Streams and Stages need to be mapped Globally and used across the Project Portfolio to bring efficient Portfolio Value to both internal Stakeholders and external Customers.

What is required is a Project Portfolio Management methodology/system focused on Value delivery and a Changing Capability which manages the portfolio using an Operations Pull basis through a Transformational Management Office (TMO).

This results-based Value Mindset/Lens approach can help Businesses transform successfully.

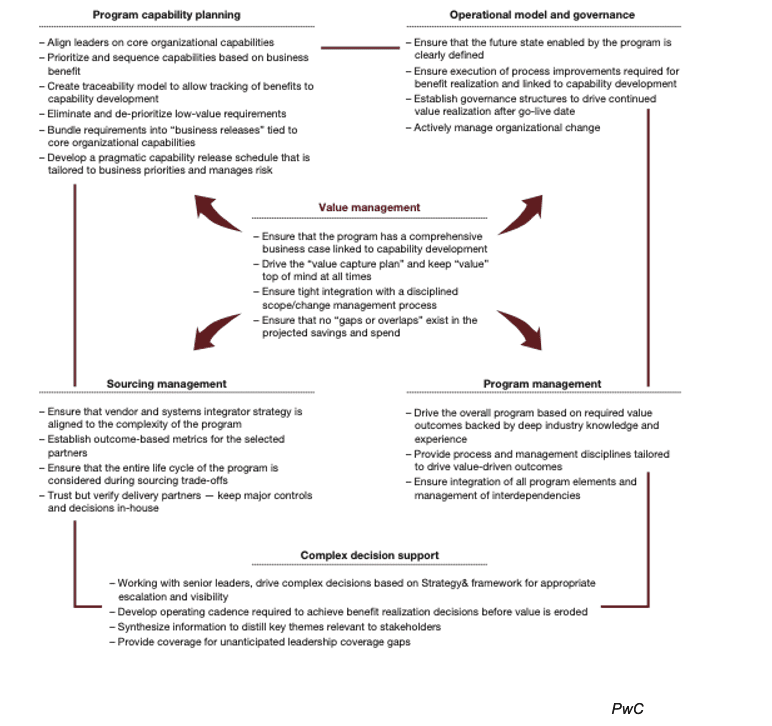

This broadly includes six components (see Figure 8), which together help organizations manage projects on an end-to-end basis and effectively translate strategy into execution.

Figure 8. Components of a Value System

Capability Planning

- What Capabilities are required?

Value Management

- Value delivered by the new Capabilities.

- Value delivered to various Stakeholders.

- How is Value Measured?

- How are we performing against our objectives?

Operational Model & Governance

- Aligns Capabilities & Value to Assets & Resources

- Highest Skilled workers on Highest Value add components.

- Escalates Problems & Risks resolved with a problem-solving strategy.

Sourcing Management

- The way to systematically manage key IT Vendors

- “trust but verify“ policy of dealing with Partners

- Capture Value via Sourcing

Program Management

- Concentrate on Leading indicators.

- Driven by Value

- TMO replaces PMO by focusing on Value.

Complex Decision Support

- A wrapper for the other 5 components

- End-to-end Program View

- This is the Framework!

Value Measurement

In these Transformation Programs capturing Value is like a “Leaking Bucket”, value is lost in all stages of a program.

- Target setting 22% loss.

- Planning 23% loss

- Implementation 35% loss

- After Implementation 20% loss

Amazingly 20% of Value loss occurs after implementation once the initiatives have been fully executed (McKinsey) and 65% of loss is outside the implementation phase!

As previously discussed, a disconnect may exist between Business Processes, Capabilities and Value Creation that may result in value lost or not achieved at all.

A lot of “Lost Value” can be attributed to a lack of proper structure to identify value drivers, linking these to detailed design and having a process in place to monitor and track realized business value.

Top reasons why Businesses aren’t realising enough value :

- Business Case doesn’t exist or is not well understood.

- Overlapping Value Across Programs

- Stakeholders are not aligned and Lack of Accountability

- Value Drivers not linked to Design decisions.

- Failure to evaluate and measure Value.

Therefore,

How is Value measured? The answer is poorly or not at all!

Firstly, start with a Value Mindset/Lens and at a high level considering the Value Equation in Figure 1, What is your Dream Outcome? What is your realistic probability of success? How long will it take to achieve your benefits in Operations? What is the effort required?

These are very important questions to consider and understand!

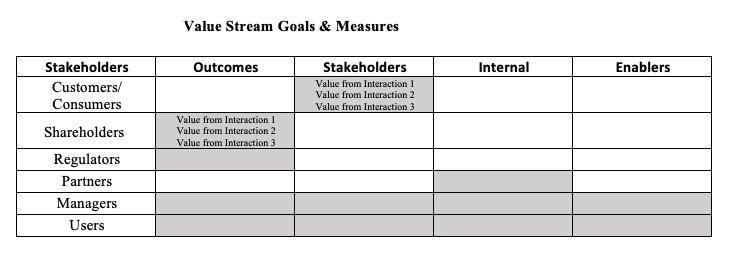

Secondly, Stakeholders (including Customers) have multiple views of Value….and they ALL matter, therefore our method of measuring value, uses all stakeholders’ values measured on a Value stream through the Balanced Scorecard (Kaplan & Norton) perspectives of Outcomes, Stakeholders, Internal Processes and Enablers see Figure 9.

Figure 9. Stakeholder Value Measures Matrix

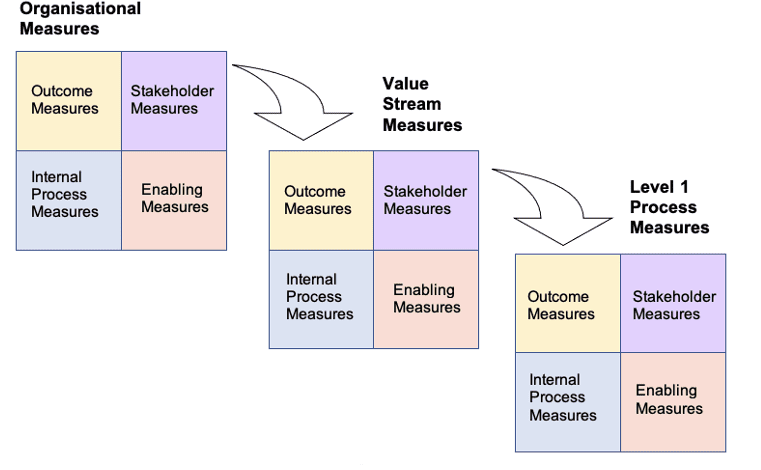

The Business can express its goals in a high-level Organisational Balanced Scorecard. The Stakeholder Values (which can be Multi levelled) in BSC form can be linked to both Organisational and Process levels creating a hierarchical structure that monitors value. see Figure 10.

The scorecards can also be used as a tool for performance evaluations, ensuring that managers are aware of their obligation to add value to the processes they manage.

Figure 10. Linked Value Stream Measures.

Competitive/Differentiating Value Streams (or Stages)

Competitive advantage has a shelf life, your Cost, Quality or Unique advantage will get eroded in time or even wiped out in a disruption event, therefore you need to be “Incubating” your next Competitive advantage and Value to multiple stakeholders and customers is critical in the choice of what Product, Service, process that will bring you a future competitive advantage.

Geoffrey Moore in his book “Zones to Win” describes 4 zones ( effectively 3 Zones as Productivity & Performance zones are your Current reality and how to improve on it ), the Incubation zone is where new products get developed & tested and Value is considered in this critical to Business in seeking to stay competitive. The Transformation zone is looking at changing Business models that are no longer sustainable and creating new Value for Customers and Stakeholders.

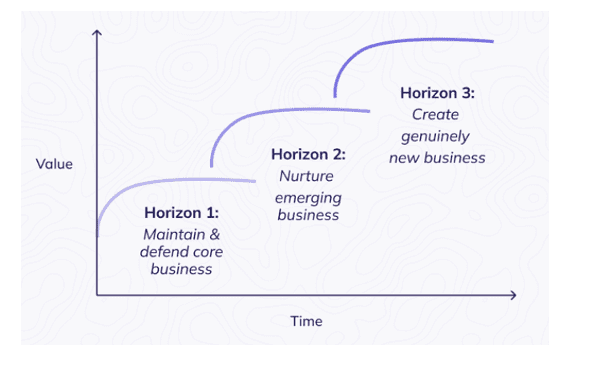

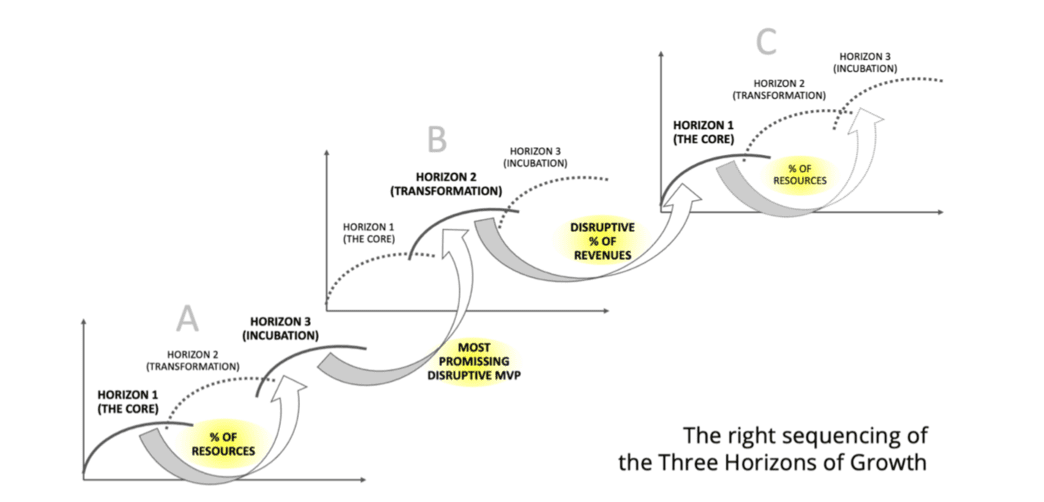

In integrating “Zones to Win” with McKinsey’s “3 Horizons of Growth” (Figure 11 & Figure 12) it’s very important to get the sequencing correct with the pre-and post-cycles.

Figure 11. 3 Horizons of Growth

Figure 12. The Correct Sequencing

Value, therefore, has a time element (when Value gets delivered) when looking beyond Horizon 1 to the Transformation Zone (Horizon 2) and the Incubation Zone (Horizon 3) and is an important factor to consider when choosing future products or services.

Regarding larger or complex Businesses with Corporate and Local Business units, the Horizons/Zones can get confusing as differing SBUs could be operating in differing Zones (to suit their local needs and remain competitive) and still must accommodate corporate strategy initiatives.

Therefore, not all Value streams (and Value stages) are equal, to maximise total Value delivery a Business must focus initially on the greater Value streams and stages (Pareto 80/20 style) and consider constraints in the Value stream that slow or prevent delivery.

M&A Sidebar

McKinsey research had previously demonstrated that companies that use a programmatic approach to Mergers & Acquisitions (M&A)—versus organic, selective, or big-deal approaches—generally outperform their peers. These companies can build lasting, distinctive capabilities in M&A precisely because they do deals frequently and systematically.

Therefore, when growing a Business (by value) via the M&A route the priority should be:

- How does this Merger or Acquisition add Capabilities to the Business?

- How does this Merger or Acquisition add Value to the Business?

- Can we build Capabilities in M&A in a programmatic continuously changing way?

Capability Leveraged and Capability Enhancement deals in a recent survey by PwC made up 73% of the M&A deals (41% & 32% respectively) with the deals delivering (56% & 57% respectively) premium over the local market Index measured in TSR (Total Shareholder Return).

The remaining 27% of deals were Limited Fit deals which delivered very little Value and were more to do with Size growth.

This highlights the importance of Capabilities in adding Value to Businesses as they take new journeys e.g. ESG (Environment, Social & Governance).

Conclusion

In the past, a Transformation project's success was measured based on its ability to deliver a quality scope, on time and within budget. Although these factors are important, they are not a true measurement of the success of a project.

A Transformation project whether it’s a Greenfield, Brownfield or Bluefield implementation can only be considered successful if it delivers the predetermined business Value to the customer and stakeholders.

When businesses look at project success in this light, they will make better decisions about which projects to execute, and executives will focus on what is important as their teams deliver value.

The “People” aspect of the Transformation project is critical, as many projects “die on this cross”, the stakeholder's multi-view of Value must be delivered to get real buy-in for the project.

When a Business is engaged in executing a Transformation project, it should consider the following steps to better deliver business value.

- Understand the vision.

- Be clear about the business value of the Transformation project.

- Evangelize the vision and business value of the Transformation project team.

- Foster a team environment to effectively deliver value.

- Understand where Value is lost or disconnected.

- Measure the realization of the business value.

When Businesses focus on delivering business value in their Transformation projects, that Capability will become more and more valuable to the organizations they serve.

What to know more? Contact joe.cadden@techshifts.io